Navigating the realm of commercial real estate can be intricate, and one fundamental concept to comprehend is the triple net lease (NNN). This type of net lease requires the tenant to pay for property expenses. This lease structure allocates a substantial portion of property expenses to tenants, rendering it a preferred option for investors and large corporations. This overview will elucidate the mechanics of triple net leases, outline their benefits and drawbacks, and delineate how they differ from standard leases—equipping stakeholders with the insights necessary for making informed decisions in their real estate ventures.

What Is a Triple Net Lease?

A triple net lease, commonly referred to as an NNN lease, is a leasing arrangement frequently utilized in commercial real estate. In this type of agreement, the tenant assumes responsibility for not only the rent but also all associated property expenses.

This structure effectively transfers the financial obligations related to property taxes, building insurance, and maintenance costs from the landlord to the tenant, thereby providing property owners with a more stable and predictable income stream. The tenant’s ability to manage these expenses often leads to lower rent rates in such lease agreements.

Under a triple net lease, tenants are accountable for the majority of the operating expenses associated with the property, which renders this option appealing to both landlords and investors seeking dependable, profit-generating real estate opportunities.

How Does a Triple Net Lease Work?

A triple net lease functions by requiring the tenant to assume responsibility for all operating expenses related to the property, which includes utilities, maintenance costs, and property taxes, in addition to the base rent. This arrangement can influence the capitalization rate and expected rate of return for landlords, establishing a clear and predictable cash flow for the landlord throughout the duration of the lease.

Triple net leases are increasingly gaining traction in Thailand’s commercial real estate sector, particularly in Bangkok and major investment hubs. Investors favor these lease structures due to their ability to provide stable returns with minimal operational involvement.More investors are now targeting NNN lease agreements due to their predictable cash flow and reduced landlord responsibilities. In the Thai market, this approach is particularly appealing to foreign investors looking for long-term returns with minimal risk exposure.

What Are the Benefits of a Triple Net Lease?

The advantages of a triple net lease are substantial, especially for landlords aiming to minimize risk while maximizing predictable income from their commercial property investments.

Additionally, tenants benefit from increased control over property expenses and may realize potential tax advantages that can improve their overall financial performance in business operations.

Low Risk for the Landlord

One significant advantage of a triple net lease is the reduced risk it offers to landlords, as they can secure reliable tenants who assume responsibility for various property expenses. This arrangement safeguards the investment from unforeseen financial burdens.

In Thailand, this model is particularly attractive to institutional investors looking to minimize risk while ensuring a steady revenue stream. Many multinational corporations prefer NNN leases as they offer long-term stability and greater autonomy in property management.

Such a structure substantially diminishes the potential financial strain on landlords, thereby minimizing the impacts of fluctuating market conditions. The lease term often includes clauses to protect against market risks.

For example, when tenants are responsible for costs such as property taxes, insurance, and maintenance, landlords can avoid unexpected expenses that frequently disrupt cash flow.

- In this context, stable tenants, particularly those with strong credit ratings, play a crucial role in sustaining a landlord’s portfolio.

- High credit ratings reflect a tenant’s capability to consistently pay rent, thereby enhancing overall investor confidence.

As a result, landlords are more inclined to enter into long-term leases with these tenants, thereby solidifying secure income streams and reducing exposure to market volatility. Understanding a tenant’s credit history provides landlords with vital insights into their reliability, effectively guiding investment decisions within the commercial real estate sector. Additionally, high credit ratings can lead to more favorable rent payment terms and lease obligations.

Predictable Income for the Landlord

A triple net lease provides landlords with the advantage of predictable income, as tenants assume lease obligations related to property expenses. This ensures a steady cash flow, which enhances the overall financial stability of the investment.

For investors in Thailand, securing long-term triple net lease agreements with creditworthy tenants—such as international retail chains or logistics firms—provides a hedge against economic fluctuations.

This arrangement presents a significant benefit for property owners by minimizing the financial risks associated with fluctuating operational costs. By transferring responsibilities such as maintenance, property taxes, and insurance to the tenant, landlords can more accurately anticipate their earnings, thereby facilitating effective budgeting and fiscal management.

Such consistency supports long-term investment strategies, allowing landlords to reinvest predictable cash flows into diversified portfolios, capital improvements, or other real estate opportunities. Additionally, this reliable revenue stream serves as a strong foundation for securing financing from lenders and enables better planning for future expenses and potential expansion.

Adopting this structure is not solely focused on immediate gains; it also integrates seamlessly with broader financial planning objectives.

Tax Benefits for the Tenant

Tenants engaged in a triple net lease arrangement typically benefit from substantial tax advantages, as they are permitted to deduct property-related expenses such as liability insurance and renters insurance from their taxable income. This can enhance their net worth over time.

Thailand’s tax laws allow businesses to deduct operational expenses, including rent and property management costs. This further incentivizes tenants to enter into long-term triple net lease agreements.

This practice promotes enhanced financial efficiency within their business operations.

Furthermore, these tenants can also deduct property taxes, maintenance costs, and utilities, which cumulatively can lead to significant savings over time. By utilizing these deductions, businesses can allocate their funds more effectively, thereby improving cash flow and facilitating reinvestment in growth opportunities.

For example, if a tenant incurs $10,000 in property taxes and $5,000 in maintenance fees annually, these expenses considerably reduce their taxable income. This financial flexibility often shapes leasing decisions, as companies seek arrangements that minimize their overall tax obligations.

Consequently, comprehending these potential savings is a crucial consideration for any business contemplating a triple net lease agreement.

Control over Property Expenses for the Tenant

A triple net lease grants tenants enhanced control over property expenses, as they assume responsibility for managing costs such as utilities, maintenance, and building insurance. This arrangement can lead to cost-saving opportunities that positively impact their financial performance.

In Thailand, companies leasing commercial spaces on NNN terms often implement efficiency measures to reduce operating costs. By optimizing expenses such as energy consumption and maintenance, tenants can better control their long-term financial planning.

By employing these strategies, tenants not only gain greater control over their expenses but also contribute to a profitable and sustainable business environment.

What Are the Drawbacks of a Triple Net Lease?

While a triple net lease offers numerous advantages, it is important to acknowledge its potential drawbacks. Notably, tenants may encounter unexpected expenses arising from their responsibility for property maintenance and other operating costs, which could place a strain on their financial resources.

1. Responsibility for Property Maintenance

One significant drawback of a triple net lease is the tenant’s responsibility for all property maintenance costs, which can lead to financial strain, particularly in the event of unexpected repairs that exceed budget expectations.

In Thailand, where infrastructure and building maintenance regulations can vary, tenants must ensure they fully understand local compliance requirements before signing a lease.

2. Potential for Unexpected Expenses

Tenants in a triple net lease may face unexpected expenses arising from unanticipated operating costs, which can disrupt their cash flow and overall financial strategy. Effective budgeting becomes essential for tenants in these situations.

For businesses operating in Thailand, it is advisable to conduct thorough due diligence, including reviewing historical maintenance costs and local tax fluctuations, to anticipate any unforeseen expenses.

Responsibility for Property Maintenance

One significant drawback of a triple net lease is the tenant’s responsibility for all property maintenance costs, which can lead to financial strain, particularly in the event of unexpected repairs that exceed budget expectations. This arrangement places the burden of property upkeep directly on the tenant, highlighting the necessity for meticulous financial planning.

Tenants must anticipate various common maintenance costs associated with commercial properties, including:

- HVAC system repairs

- Roof replacements

- Landscaping and snow removal

- Plumbing repairs

These expenses can substantially affect their monthly budget, making it essential to maintain a financial reserve.

Conducting a thorough inspection before signing a lease is vital, as it assists in identifying potential issues that may necessitate costly repairs in the future. This proactive strategy not only protects their financial interests but also ensures that they enter into a lease agreement with a comprehensive understanding of the property’s condition. Moreover, this awareness can aid in tenant negotiation and long-term planning.

Potential for Unexpected Expenses

Tenants in a triple net lease may face unexpected expenses arising from unanticipated operating costs, which can disrupt their cash flow and overall financial strategy. This risk is particularly pronounced when unforeseen expenses, such as maintenance costs or increases in property taxes, are not adequately planned for, potentially leading to significant financial strain.

Consider the scenario of a retail tenant who entered into a triple net lease in an area where property taxes had historically remained stable. Unforeseen costs emerged when the local government initiated a reevaluation, resulting in a substantial increase in property taxes. The tenant had not accounted for these additional expenses, which severely affected their operational budget.

- Effective budgeting becomes essential for tenants in these situations.

- Contingency planning for potential expense increases can help mitigate these risks.

Such case studies highlight the importance for tenants to thoroughly evaluate historical data and anticipate potential changes in operating costs, such as utility expenses and common area expenses. This proactive approach ensures the maintenance of cash flow stability while adhering to their overall financial strategy, enabling tenants to efficiently manage their monthly costs.

Triple Net Lease in Thailand: A Growing Investment Trend

Investors are increasingly seeking NNN lease properties, particularly in high-demand sectors such as logistics, industrial spaces, and retail chains. The Thai commercial real estate market is witnessing a surge in demand for structured, long-term leases that align with global investment trends.

Thailand’s growing economy, coupled with an increase in foreign direct investment, has made NNN lease properties an attractive option. Investors seeking predictable income streams with minimal management responsibilities are leveraging this model to capitalize on Thailand’s real estate growth.

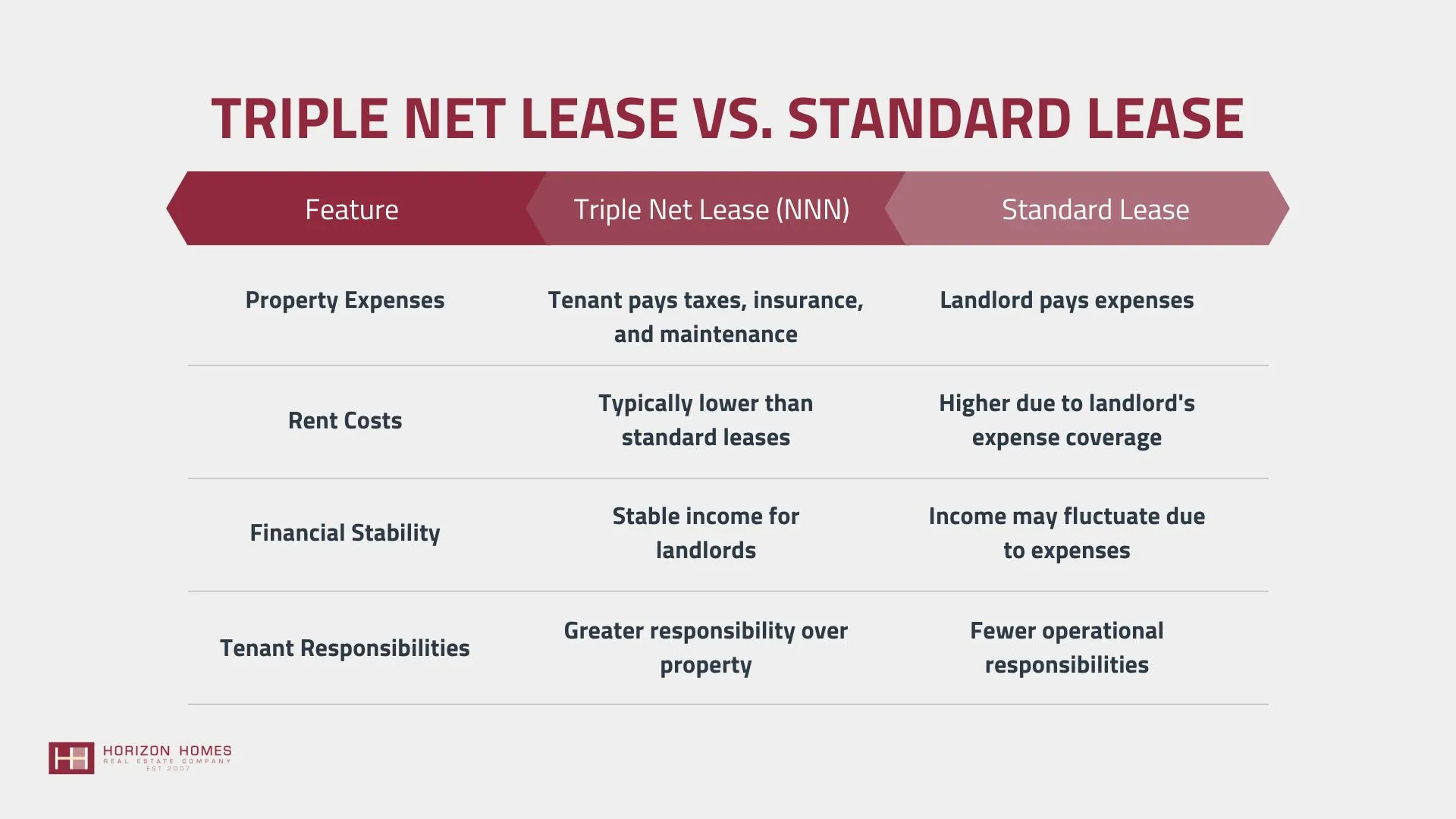

How Is a Triple Net Lease Different from a Standard Lease?

The distinctions between a triple net lease and a standard lease are substantial, particularly regarding the payment structure, responsibilities for property expenses, and the overall duration of the lease. A triple net lease, often referred to as an NNN lease, imposes greater financial obligations on the tenant, such as real estate taxes and insurance premiums. A triple net lease imposes greater financial obligations on the tenant, while simultaneously providing potential advantages for landlords.

Payment Structure

The payment structure of a triple net lease uniquely mandates that tenants are responsible not only for the rent payment but also for various property expenses, including real estate taxes, insurance premiums, and maintenance costs. This differs from a standard lease, where such expenses are typically borne by the landlord.

This distinctive arrangement has significant implications for both landlords and tenants, influencing profitability, financial planning, and rental income strategies. In a typical scenario, costs such as property taxes, insurance, and essential maintenance fall under the tenant’s responsibility, fundamentally altering their budgeting process. In a typical scenario, costs such as property taxes, insurance, and essential maintenance fall under the tenant’s responsibility, fundamentally altering their budgeting process.

- Real estate taxes: These costs can vary significantly based on the property’s location and size, often resulting in unexpected financial burdens for tenants.

- Insurance premiums: Coverage for the property is essential and impacts overall costs, necessitating that tenants seek competitive rates to manage expenses effectively.

- Maintenance costs: Regular upkeep, repairs, and emergency services, which may sometimes appear as minor expenses, can accumulate and substantially affect profitability.

Ultimately, comprehending these costs, such as rental income and their fluctuations, is crucial for tenants seeking to maintain profitability and ensure stable cash flow in their financial planning.

Responsibilities for Property Expenses

In a triple net lease, the responsibilities for property expenses are significantly transferred to the tenant, who becomes accountable for all associated costs. This necessitates careful negotiation by the tenant to ensure clarity regarding lease obligations.

This type of lease clearly delineates the duties between the landlord and tenant, imposing unique obligations on the latter. Understanding these nuances is essential for tenants to avoid unexpected financial burdens. Under this arrangement, the tenant typically assumes responsibility for property taxes, insurance, and maintenance costs, all of which can substantially impact overall expenses.

- Property Taxes: The tenant is responsible for paying property taxes, which may vary from year to year.

- Insurance: The tenant must maintain an appropriate level of insurance as specified in the lease.

- Maintenance: Regular maintenance tasks also fall on the tenant, requiring timely repairs and upkeep.

Given these additional responsibilities, thorough negotiations and precisely defined lease language are of utmost importance, as they help to prevent misunderstandings that may arise from ambiguity in the contract. Tenants should ensure that all responsibilities, limitations, and expectations are documented clearly to promote a harmonious landlord-tenant relationship.

Length of Lease

The duration of a triple net lease is typically more extensive than that of a standard lease, often ranging from five to fifteen years. This arrangement provides landlords with a more stable investment opportunity while offering tenants security in their business operations.

In such agreements, longer lease terms not only enhance the predictability of income for property owners but also enable tenants to plan their expenditures with greater assurance over an extended timeframe. While landlords benefit from guaranteed rental income and a reduced risk of vacancy, tenants experience stability and the opportunity to develop their businesses without the continuous pressure of relocating.

This mutually beneficial relationship cultivates an environment in which both parties can prosper, allowing landlords to formulate long-term investment strategies that leverage reliable cash flow and possibly explore investment trusts, while tenants can negotiate favorable lease terms that support their operational expansion.

- For landlords, longer leases can lead to decreased turnover and associated costs.

- Tenants can establish a robust brand presence when assured of a stable location.

Ultimately, the implications of lease length significantly influence financial planning and operational efficiency for both landlords and tenants.

Who Is a Triple Net Lease Best Suited For?

A triple net lease is particularly advantageous for commercial real estate investors seeking dependable revenue streams and steady income, large corporations that necessitate stability for their business operations, and long-term tenants who prioritize control over property expenses and consistent occupancy in high-grade properties.

Commercial Real Estate Investors

Commercial real estate investors frequently favor triple net leases due to their status as a reliable investment vehicle, providing consistent income and steady income streams while minimizing the management responsibilities typically associated with property ownership.

This preference is supported by several compelling factors that enhance the overall appeal of such investments:

- The financial advantages of triple net leases are considerable, as they generally offer higher yields compared to traditional lease agreements. This translates to increased profitability for investors over time.

- The reduction in management responsibilities is particularly appealing; landlords are not accountable for property taxes, insurance, and maintenance costs, as these obligations are transferred to tenants. This arrangement liberates valuable time and resources, enabling investors to concentrate on expanding their portfolios.

- Furthermore, investing in properties with triple net leases often results in high-quality acquisitions, as many of these agreements are secured by creditworthy tenants, such as national retail chains, which ensures a stable revenue stream.

Large Corporations

Large corporations frequently derive significant advantages from triple net leases, as these arrangements provide long-term stability and predictability in their financial commitments. This enables them to allocate resources efficiently while ensuring operational continuity.

This leasing structure, commonly known as triple net leases, offers substantial financial benefits, particularly in sectors such as retail, logistics, and corporate offices, including shopping malls and industrial parks. By agreeing to cover property taxes, insurance, and maintenance costs, large enterprises can enhance their management of cash flows and operational expenses. By agreeing to cover property taxes, insurance, and maintenance costs, large enterprises can enhance their management of cash flows and operational expenses.

Ultimately, the flexibility and diminished financial burden associated with triple net leases align seamlessly with the strategic objectives of these large corporations, promoting both growth and stability in a fluctuating market.

Long-term Tenants

Long-term tenants are ideally suited for triple net leases, as they frequently seek to establish permanent locations and prefer the lease obligations that accompany a stable environment for their business operations.

This leasing arrangement offers numerous advantages, enabling tenants to effectively manage their operational costs, such as rent escalation and utility expenses, while fostering a sense of ownership over their space. By assuming responsibility for property-related expenses such as maintenance, taxes, and insurance, tenants gain valuable insight into costs that can be strategically managed, which is essential for long-term financial planning and forecasting expenses. With the ability to control these factors, they often find it easier to budget and forecast expenses, which is crucial for sustained growth and profitability. With the ability to control these factors, they often find it easier to budget and forecast expenses, which is crucial for sustained growth and profitability.

Another significant benefit of a triple net lease is the enhanced stability it offers. Longer lease terms can lead to reduced disruption, allowing tenants to concentrate on building their brand and customer base within a consistent environment.

The advantages of a triple net lease include:

- Reduced administrative responsibilities, as property owners generally retain responsibility for the structural integrity of the building.

- The potential for lower rental rates compared to gross leases, owing to the tenant’s direct contribution toward property costs.

- Enhanced operational autonomy, which can facilitate the creation of customized spaces that align with specific business needs.

Engaging in an NNN lease enables long-term tenants to establish a solid foundation for their enterprise while minimizing the risk of unexpected financial burdens from their business activities.

Conclusion

A triple net lease offers landlords stability, predictable income, and reduced operational burdens while allowing tenants greater control over property expenses. However, potential risks such as unexpected maintenance costs should be carefully evaluated.

In Thailand, the rising popularity of triple net leases is reshaping the commercial real estate landscape. Investors and businesses seeking secure, long-term leasing agreements should consider the benefits and challenges associated with NNN leases before entering into an agreement.

Understanding the Thai market, local regulations, and economic trends is essential to maximizing the benefits of a triple net lease investment. Whether you are a landlord or a tenant, strategic planning and thorough due diligence are critical for making informed leasing decisions in Thailand’s evolving commercial real estate sector.

Frequently Asked Questions

Negotiating a triple net lease necessitates thorough consideration of multiple factors, including tenant negotiation strategies, lease obligations, property management, and a clear understanding of property expenses. This diligence is essential to establish a fair and mutually beneficial agreement for both parties involved.

Examples of triple net leases in the real estate market encompass a range of commercial properties, including office buildings, shopping malls, pharmacies, residential units, and restaurant chains.

This leasing structure is employed to deliver stability and predictability for both landlords, ensuring stable income, and tenants.

Yes, triple net leases can be used for any type of property, including commercial, retail, and residential properties. However, they are most commonly used for commercial properties, such as office buildings, retail spaces, and industrial buildings, often under various leasing agreements.

One potential drawback of a triple net lease for the landlord is that they may have less control over the property, as the tenant is responsible for making decisions regarding maintenance and renovations. For tenants, the primary drawback may be the added financial responsibility of paying for property expenses in addition to rent.

The decision to enter into a triple net lease should be carefully considered by both the landlord and tenant. It is important to thoroughly review the terms of the lease and assess the potential benefits and drawbacks, including the financial strength of the tenant. Consulting with a real estate professional such as Horizon Homes can also be helpful in making an informed decision, particularly for accredited investors.