What Is a Capitalization Rate?

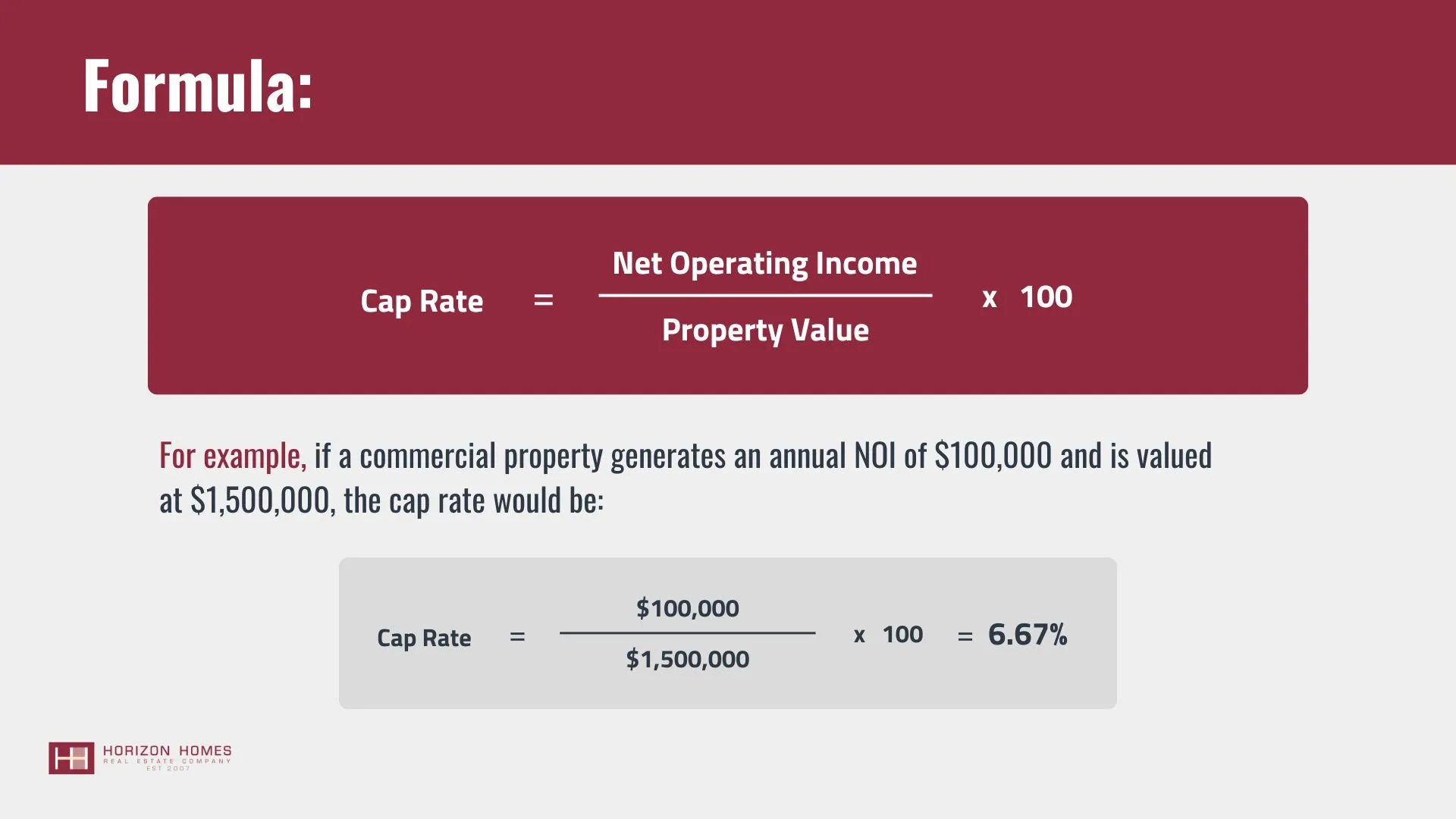

Capitalization rate (cap rate) is one of the most critical metrics in real estate investment, offering a clear measure of the potential return on an investment property. Expressed as a percentage, the cap rate is calculated by dividing the property’s net operating income (NOI) by its current market value. Investors use this metric to assess the profitability and risk level of a real estate asset.

Why Are Cap Rates Important?

Cap rates provide a standardized way to compare different real estate investments. They help investors determine:

- The expected return on an asset

- The relative risk of different properties

- The value of a property in the current market

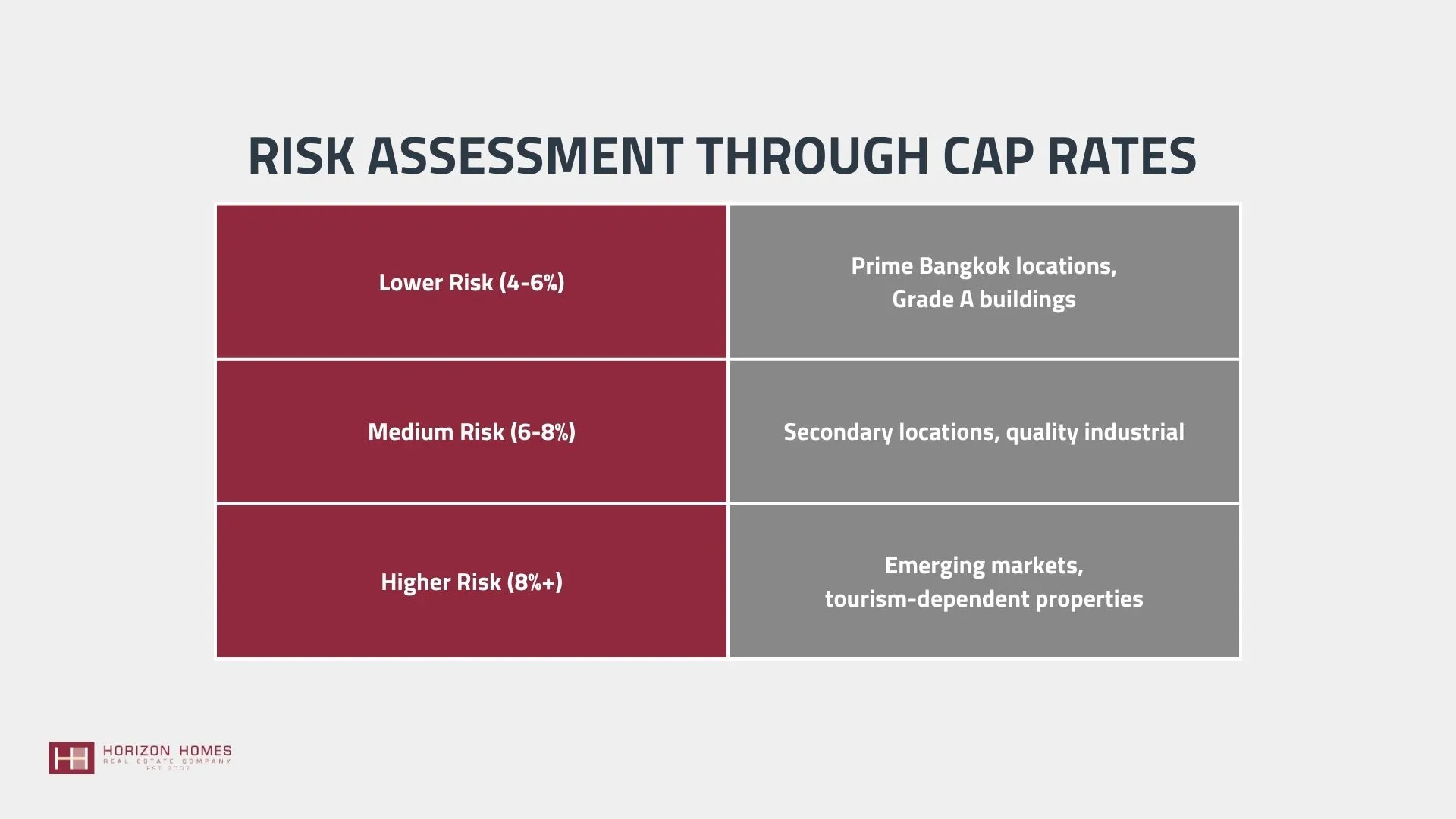

A higher cap rate generally indicates higher risk but greater potential returns, while a lower cap rate suggests a more stable but lower-yielding investment.

Factors Influencing Cap Rates

Several factors affect a property’s cap rate, including:

Location Factors

- Prime locations typically have lower cap rates due to high demand and lower risk

- Proximity to mass transit, highways, and amenities

- Economic zone designation

- Neighborhood development stage

Property-Specific Factors

- Property Type: Residential, commercial, and industrial properties have varying risk profiles

- Tenant Stability: Properties leased to high-credit tenants often yield lower cap rates due to reduced risk

- Operational Expenses: High maintenance costs can lower NOI, affecting the cap rate

- Building age and condition

- Lease terms and structure

Market Conditions

- Economic factors

- Interest rates

- Rental demand

- Tourism trends (especially relevant for resort areas)

- Foreign investment levels

Cap Rates in the Thailand Real Estate Market

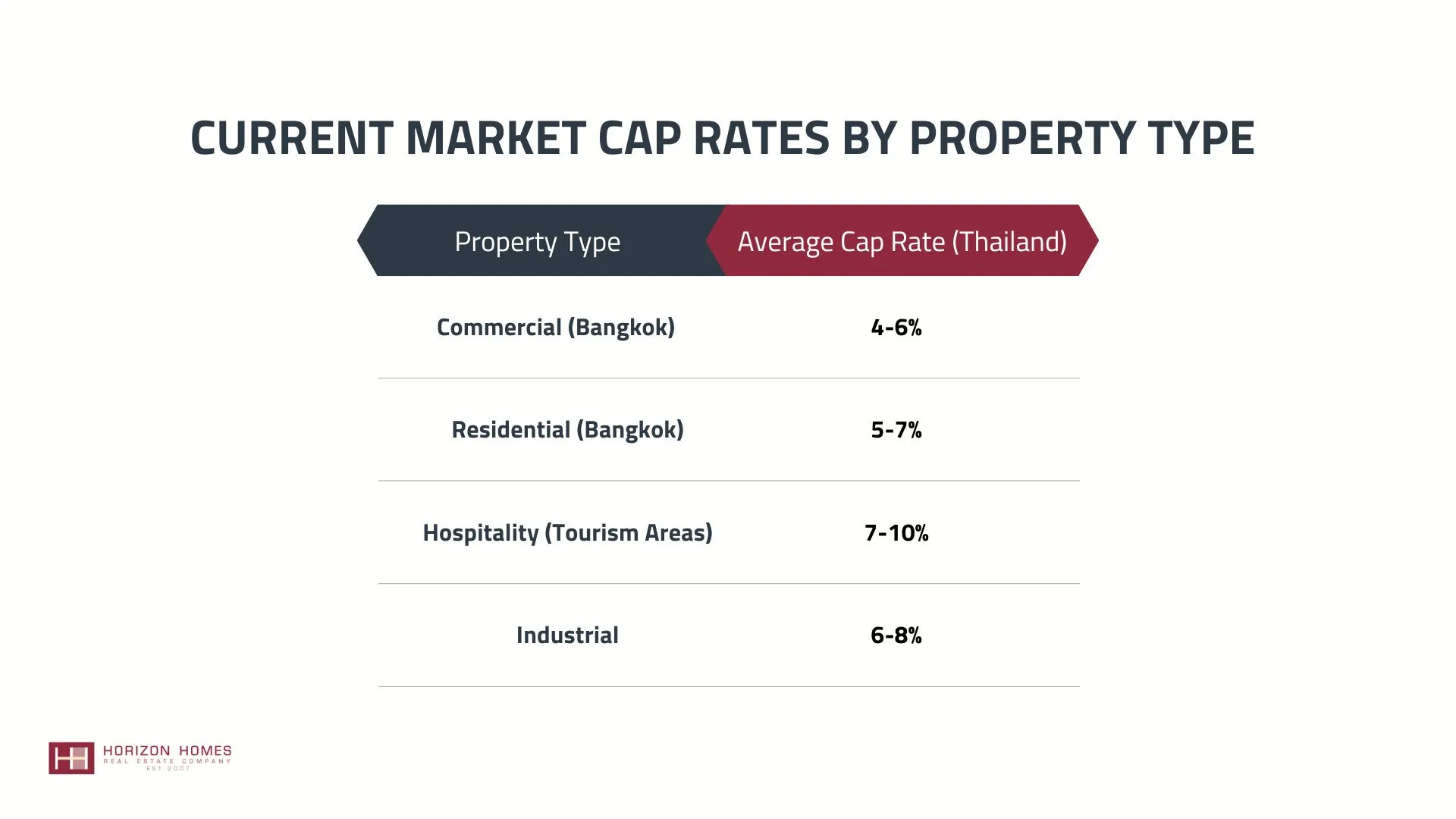

Thailand’s real estate market, particularly in cities like Bangkok, Phuket, and Koh Samui, has seen fluctuating cap rates depending on property type and location. According to industry reports:

In emerging markets such as Koh Samui, the cap rates can be higher, often reaching 8% or more, due to growing tourism demand and increasing foreign investments. The variation in cap rates highlights the importance of thorough market research before investing.

Cap Rates vs. Other Investment Metrics

While cap rates are essential, they should not be the sole determinant of an investment decision. Other key metrics include:

- Cash-on-Cash Return: Measures the annual pre-tax cash flow relative to the initial cash investment

- Internal Rate of Return (IRR): Evaluates the overall profitability of an investment over time

- Gross Rental Yield: The total rental income as a percentage of property value

- Debt Service Coverage Ratio: Measures the property’s ability to cover debt payments

Thailand-Specific Considerations

When evaluating cap rates in Thailand, consider:

- Foreign ownership restrictions

- BOI promotion zones

- Tourist area regulations

- Lease structures (30+30 year leases)

- Property management costs

- Utility expenses

- Staff availability and costs

Cap Rates and Professional Guidance

For investors considering Thailand, particularly the resort market, working with local real estate professionals is valuable for:

- Accurate property valuation

- Legal compliance understanding

- Tax structuring optimization

- Market analysis and trends

- Due diligence support

Final Thoughts

Cap rates serve as a fundamental tool for real estate investors, providing insights into expected returns and risk levels. In Thailand, particularly in cities like Bangkok and resort destinations like Koh Samui, cap rates vary based on location, property type, and economic trends. By working with experienced professionals such as Horizon Homes, investors can navigate the market effectively and make strategic investment choices that align with their financial goals.

Understanding cap rates alongside other metrics and local market factors is essential for making informed investment decisions in Thailand’s dynamic real estate market. While cap rates provide a useful starting point, successful investment strategies must consider the broader context of market conditions, property-specific factors, and individual investment objectives.

Essential FAQs About Cap Rates in Thailand

A cap rate is a key metric that measures a property’s potential return on investment, calculated by dividing the net operating income by the property’s value. It’s crucial because it helps you compare different properties across Thailand’s diverse markets and understand the risk-return relationship. For example, a 4% cap rate in central Bangkok versus an 8% cap rate in Koh Samui tells you about both the risk level and potential returns of each investment.

Good cap rates vary significantly by location and property type in Thailand:

- Bangkok prime commercial: 4-6% (lowest risk)

- Bangkok residential: 5-7% (moderate risk)

- Tourist areas (Phuket/Samui): 7-10% (higher risk/return)

- Industrial properties: 6-8% (moderate to high risk) Lower rates typically indicate safer investments but lower potential returns.

Calculate Net Operating Income by:

- Start with annual gross rental income

- Subtract all operating expenses:

- Property management fees (typically 5-10%)

- Maintenance costs

- Insurance

- Property taxes

- Utilities (if not paid by tenants)

- Staff costs Important: Don’t include mortgage payments or income taxes in this calculation.

Cap rates directly indicate risk levels in the Thai market:

- 4-6%: Premium properties in prime locations (lowest risk)

- 6-8%: Quality properties in secondary locations (moderate risk)

- 8%+: Emerging locations or tourist areas (highest risk/potential) Always consider that higher cap rates come with both higher potential returns and higher risks.

Foreign ownership restrictions can significantly impact cap rates through:

- Limited buyer pools for certain property types

- Required legal structures for foreign ownership

- Additional costs for property management

- Specific lease structures (like 30+30 year leases) These factors should be considered when comparing cap rates across different property types.

No, while cap rates are important, they should be considered alongside:

- Cash-on-cash return

- Potential for appreciation

- Location and accessibility

- Property condition

- Legal restrictions (especially for foreign investors)

- Market growth prospects This is particularly important in Thailand’s diverse real estate market, where other factors can significantly impact overall returns.

Consult professionals when:

- Dealing with foreign ownership structures

- Evaluating properties in unfamiliar markets (especially tourist areas)

- Analyzing complex commercial properties

- Requiring detailed financial projections Local expertise is particularly valuable in Thailand’s diverse real estate market.