Thailand’s Property Tax Reform: Navigating the New Landscape

Recent amendments to property tax legislation in Thailand aim to enhance tax fairness and stimulate the effective use of land which is a distinct shift from the previous tax code. Owners of residential, agricultural, commercial, and undeveloped land are all subject to the revised tax scheme, which introduces progressive rates based on property type and value, effectively reduce land and building tax payment by 15% in 2023. With the precise application of these laws differing based on various criteria, including property location and usage, identifying the specific impacts on an investment portfolio necessitates diligent attention to the intricacies of these legal modifications.

How tax system works in Thailand?

Deciphering Thailand’s Land and Building Tax System

Thailand’s Land and Building Tax came into effect from 2020 and represents a reformation of the country’s property tax regime. This tax applies to immovable property, encompassing land, buildings, and structures attached to land. With an aim to encourage the productive use of land and property, this system categorizes taxable properties into specific groups, each subject to different tax rates.

Properties Under the Land and Building Tax Act

- Residential: Primary dwellings for owners

- Agricultural: Land used for farming and agricultural activities

- Commercial/Industrial: Properties used for commerce or manufacturing

- Vacant: Unused or unproductive land

Property Tax Calculation in Thailand

Residential, agricultural, commercial, and vacant properties are all treated uniquely under the tax structure.

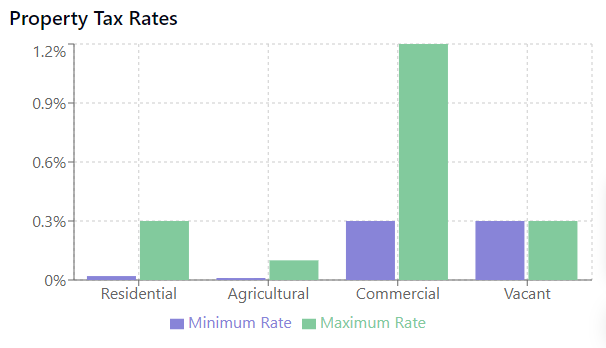

Tax rates in Thailand exhibit a tiered structure, dependent on property type.

- Residential Properties: 0.02% to 0.3% based on value and ownership (individual vs. corporate)

- Agricultural Land: 0.01% to 0.1% progressively based on value

- Commercial and Vacant Land: 0.3% to 1.2% based on value and usage

- vacant properties: An initial rate of 0.3% applies, with increments every three years.

Let’s say you sell a property for 4,000,000 Baht.

- Income from selling property: 4,000,000 Baht

- Deduct purchase expenses: Assume 0 Baht for simplicity.

- Deduct additional expenses: Assume 0 Baht for simplicity.

- Deduct expenses based on the possession period (8 years = 50%):

- 50% of 4,000,000 Baht = 2,000,000 Baht

Calculate the taxable income:

- 4,000,000 Baht (income) – 2,000,000 Baht (deducted expenses) = 2,000,000 Baht

Deduct annual expenses:

- For simplicity, assume 0 Baht.

Calculate annual tax:

- For the first 0 – 300,000 Baht, taxed at 5%:

- 5% of 300,000 Baht = 15,000 Baht

Calculate total tax:

- Assume there are no additional taxes to keep it simple.

- Therefore, the total tax would be 15,000 Baht for this portion.

To summarize:

- Income from selling property: 4,000,000 Baht

- Deduct expenses based on possession period: 2,000,000 Baht

- Taxable income: 2,000,000 Baht

- Annual tax for first 300,000 Baht at 5%: 15,000 Baht

- Total tax: 15,000 Baht

Physical enhancements, or belongings, on a property do not go unnoticed in tax assessments. Additions to properties, ranging from structures to improvements, influence tax rates significantly, by raising the valuation on which taxes are levered.

- A home with extensive renovations will find itself within a higher tax bracket than an unimproved counterpart.

- Similarly, commercial properties enhanced with modern facilities may see a tax rate upsurge due to increased valuation.

- Agricultural land equipped with advanced irrigation systems will undergo reevaluation, potentially altering its tax category

Detailed Steps for Different Property Types

For residential properties, once the appraised value is ascertained, a threshold exclusion of 50 million THB applies. Any value beyond this is subject to rates that range from 0.02% to 0.3% depending on whether the owner is an individual or a corporate entity. As an illustration, a residential property appraised at 60 million THB owned by an individual would incur tax only on the 10 million THB over the threshold.

Agricultural land taxation follows a progressive rate, starting at 0.01% for properties valued up to 75 million THB and escalating incrementally to a ceiling of 0.1%. A 20-million-THB farm, hence, would see taxation at the prescribed rate for its entire value, without any exclusion.

The procedure for commercial and vacant lands involves identifying their appraised value followed by applying a rate that begins at 0.3% and can increase up to 1.2%. A vacant plot valued at 10 million THB would be liable for tax at the base rate, whereas a commercial establishment valued at 200 million THB might attract a higher rate due to its increased valuation.

- Determine the type of property – residential, agricultural, commercial, or vacant.

- Evaluate the appraised value of the property as established by the government.

- Apply the exclusion threshold for residential properties where applicable.

- Calculate the tax due by applying the corresponding rate to the property’s appraised value.

Case scenarios with numerical examples provide concrete insights into these calculations, helping property investors better forecast their tax liabilities. Through this, they can incorporate tax considerations into their financial planning with greater precision, ensuring compliance while optimizing their investment strategies in Thailand.

Tax Incentives for Property Investment in Thailand

Thailand’s property market extends various incentives to bolster investment appeal. Benefits range from reduced tax rates to special deductions, specifically designed to augment an investor’s financial landscape. Knowledge of these advantages proves indispensable for those strategizing their entry or expansion in Thailand’s real estate sector.

List of Attractive Incentives

- Deductions for residential property investments

- Special programs for commercial properties (e.g., hotels)

- Occasional temporary tax relief measures

Navigating Tax Obligations in Thailand for Foreign Property Owners

Foreign property owners in Thailand face specific tax responsibilities. Acquisition of real estate in this jurisdiction demands adherence to local tax laws, which may differ substantially from those in an investor’s home country. Understanding these obligations ensures compliance and avoids legal complications down the line.

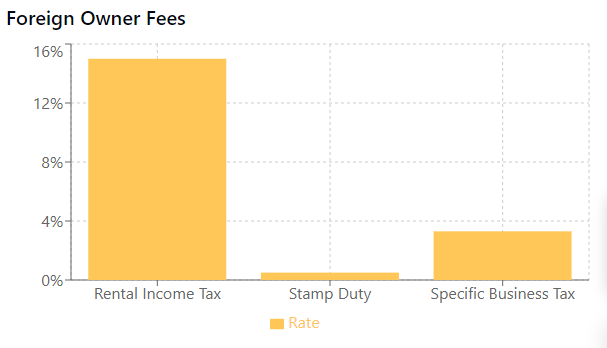

Tax Duties When Renting Out Property

Foreign investors generating income from property rentals in Thailand are subject to withholding tax. This tax is deducted at source, meaning tenants are required to withhold a portion of the rent and remit it to the Thai government. The standard withholding tax rate for non-resident landlords is 15% of the gross rental income.

Fiscal Liabilities Upon Property Sale

Selling property in Thailand entails fiscal implications for foreign owners. A withholding tax also applies in this scenario, calculated on either the appraised value of the property or the actual selling price, depending on which is higher. This tax serves as a prepayment towards the seller’s income tax liability arising from the gain on sale. Additionally, specific duty fees such as Stamp Duty or Specific Business Tax may also apply, along with any applicable municipal taxes.

- Stamp Duty: Typically charged at a rate of 0.5% of the registered sale value or the assessed value, whichever is higher.

- Specific Business Tax: This applies to properties sold within five years of purchase and is calculated at 3.3% of the appraised or actual selling price.

Engagement with experienced local tax consultants or legal advisors can greatly assist foreign property owners in navigating these tax waters. Sophisticated understanding of these financial obligations will optimize the fiscal outcomes of property investment in Thailand.

Thailand Property Tax Compliance for Investors

- Investors should file their tax declaration with the respective local government office.

- Property tax payments are due annually, typically by April 30th.

- A delay in payment results in a monthly surcharge of 1.25% on the outstanding tax.

- Property transaction records must be preserved for at least five years.

- Online payment options are available, offering a convenient alternative to in-person payments.

Remaining abreast of changes in tax legislation is necessary for ongoing compliance.

Navigating Thailand’s Property Tax Landscape

Every investor must assimilate the workings of tax laws to stave off unexpected costs and optimize their investment’s profitability. Familiarity with the calculation methods, exemptions, reductions, and compliance procedures builds a foundation for sturdy investment strategies.

Keeping abreast of the latest tax policy updates is non-negotiable. A liaison with taxation experts or continuous research guards against the pitfalls of regulatory changes. Furthermore, understanding the tax implications for foreign ownership and the process of appealing tax assessments steer s investors clear of legal complications.

Whether scouting for residential havens, commercial endeavors, or industrial setups, tax rates and incentives outline the landscape of investment returns. Local government mechanisms for tax collection lay the groundwork for smooth fiscal operations, as does securing a Tax Identification Number (TIN) in Thailand.