Rental income is the foundation of profitability in real estate investments. Accurately analyzing and calculating potential rental income ensures investors make informed decisions, maximizing returns while mitigating risks.

Key Factors Influencing Rental Income

Several factors determine the rental income of a property, including:

- Location: Prime areas with high demand yield higher rental income

- Property Type: Residential, commercial, and vacation rentals have different income potentials

- Market Demand: The occupancy rate and rental trends impact earnings

- Operating Expenses: Property management fees, maintenance, and property taxes reduce net rental income

- Economic Conditions: Inflation, employment rates, and tourism affect rental demand and pricing

The 2% Rule for Quick Assessment

Before diving into detailed calculations, investors often use the 2% rule as an initial screening tool. This rule suggests that a property’s monthly rent should be at least 2% of its purchase price to be considered a good investment. For example, a property purchased for THB 5,000,000(15,0000.00 USD) should generate at least THB 100,000 (3000.00USD) in monthly rent.

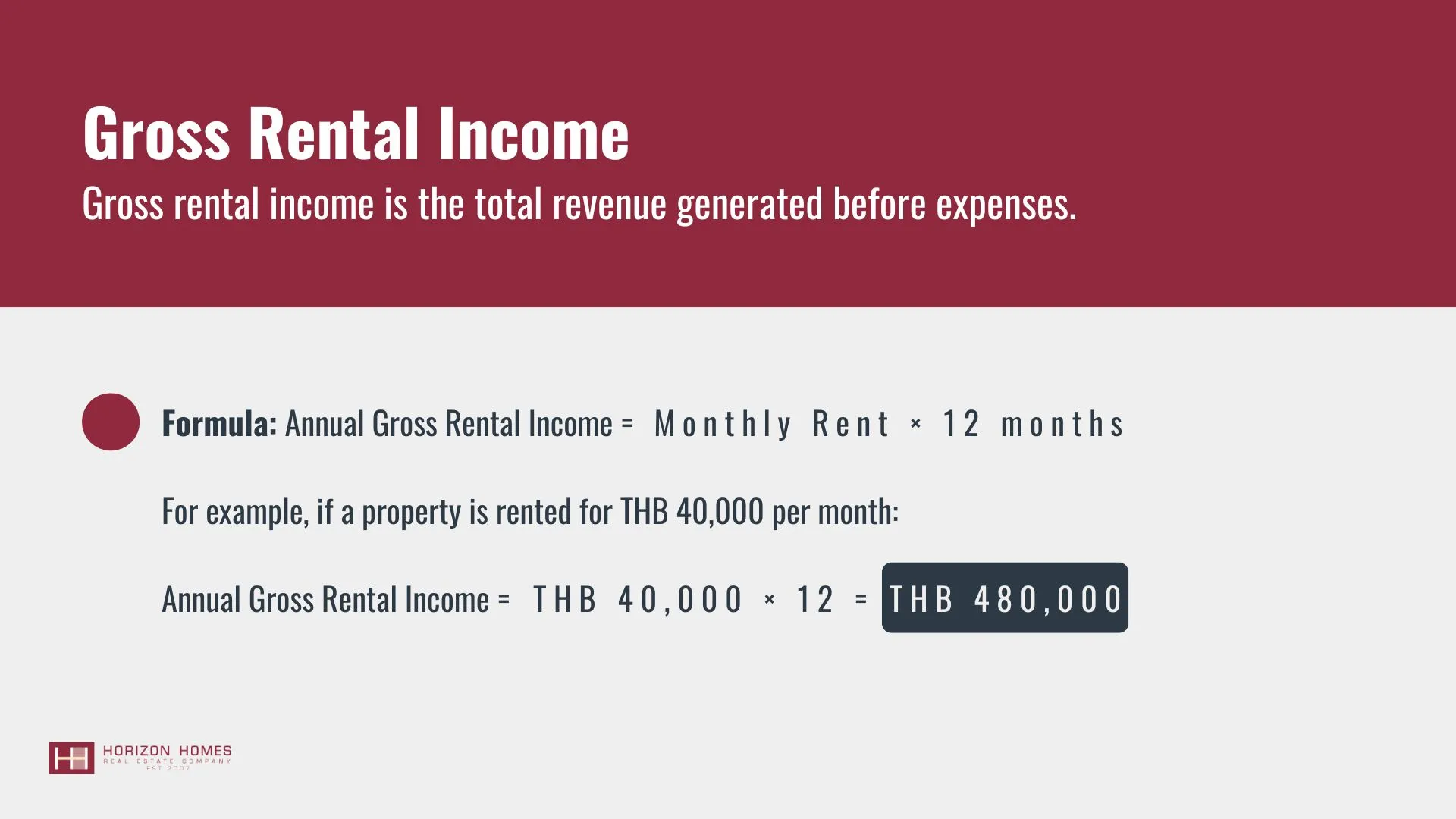

Calculating Rental Income

Operating Expenses Breakdown

To calculate net rental income, consider these expenses:

- Property management fees (8-12% of rental income in Thailand)

- Maintenance and repairs

- Property insurance

- Taxes and government fees

- Condominium management fees (if applicable)

- Vacancy reserve (typically 5-10% of gross income)

Net Rental Income

Net rental income accounts for all operating expenses:

Formula: Net Rental Income = Gross Rental Income – Total Operating Expenses

For instance, with total annual operating expenses of THB 100,000: Net Rental Income = THB 480,000 – THB 100,000 = THB 380,000

Advanced Financial Metrics

Rental Yield Calculations

Gross Rental Yield

Formula: Gross Rental Yield = (Annual Gross Rental Income / Property Value) × 100

For a property costing THB 10 million: Gross Rental Yield = (THB 480,000 / THB 10,000,000) × 100 = 4.8%

Net Rental Yield

Formula: Net Rental Yield = (Annual Net Rental Income / Property Value) × 100

With a net income of THB 380,000: Net Rental Yield = (THB 380,000 / THB 10,000,000) × 100 = 3.8%

Cash-on-Cash Return

This metric helps investors understand the return on their actual cash investment:

Formula: Cash-on-Cash Return = (Annual Cash Flow / Total Cash Investment) × 100

For example, if your down payment and closing costs total THB 2,000,000: Cash-on-Cash Return = (THB 380,000 / THB 2,000,000) × 100 = 19%

Capitalization Rate (Cap Rate)

The Cap Rate helps compare different properties:

Formula: Cap Rate = (Net Operating Income / Property Value) × 100

Tax Considerations in Thailand

Tax Deductions and Allowances

- Standard deduction: 30% of gross rental income

- Actual expense deduction (with proper documentation)

- Depreciation allowances

Tax Filing Requirements

- Annual filing using P.N.D. 90 or P.N.D. 91 forms

- Withholding tax of 5% applies when tenants are businesses

- Foreign investors should check applicable Double Taxation Agreements

Risk Analysis and Management

Sensitivity Analysis

Consider how changes in these factors affect returns:

- Vacancy rates

- Interest rates

- Property management costs

- Maintenance expenses

- Market rental rates

Record-Keeping Requirements

Maintain detailed records of:

- Lease agreements

- Rental income receipts

- Expense receipts and invoices

- Maintenance records

- Tax documents

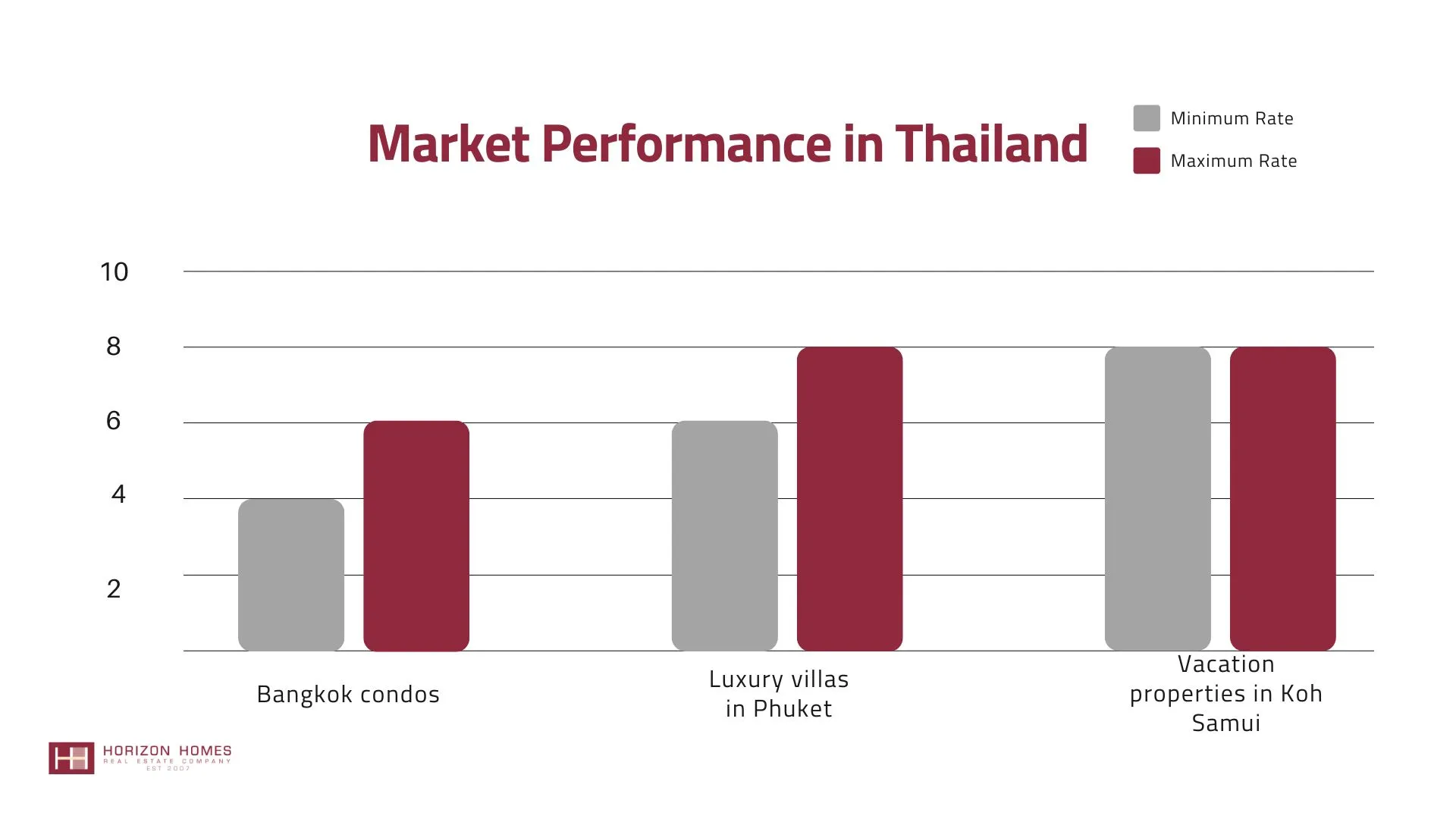

Market Performance in Thailand

Professional Support Recommendations

When to Seek Professional Help

- Tax advisors for complex tax situations

- Property managers for efficient operations

- Legal counsel for compliance issues

- Real estate agents for market analysis

Case Study: Bangkok Condominium Investment

Let’s analyze a typical Bangkok condominium investment:

Purchase Price: THB 5,000,000 Down Payment: THB 1,000,000 Monthly Rent: THB 25,000

Calculations:

- Annual Gross Income: THB 300,000

- Operating Expenses (30%): THB 90,000

- Net Income: THB 210,000

- Gross Yield: 6%

- Net Yield: 4.2%

- Cash-on-Cash Return: 21%

Successful rental property investment requires comprehensive analysis of all financial aspects, from basic rental calculations to advanced metrics and tax considerations. In Thailand’s evolving market, understanding these elements while maintaining proper documentation and seeking professional guidance when needed will help investors maximize their returns while minimizing risks.

Regular review and adjustment of your investment strategy based on market conditions, property performance, and changing regulations will ensure long-term success in Thailand’s rental property market.