Thinking about protecting your property in Thailand? Property insurance—often called home insurance or homeowners insurance—is essential for safeguarding your home and belongings from unexpected events like fires, floods, and theft. Whether you’re a new homeowner or looking to update your coverage, understanding property insurance is crucial to ensuring your home is well-protected.

In this guide, we’ll walk through the key aspects of property insurance in Thailand. We’ll discuss the types of coverage available, typical costs, and tips for finding the right policy for your needs. By understanding what to look for, you’ll be able to make informed decisions and feel confident in the protection your home insurance policy provides.

Overview of Property Insurance in Thailand

Property insurance in Thailand offers financial security by covering damages to your home from a variety of risks, including fire, storms, theft, and natural disasters. Unlike some countries, home insurance isn’t required by law in Thailand, but it’s highly recommended. Many areas are prone to floods and storms, making a solid property insurance policy an invaluable investment for protecting your home and assets.

Types of Property Insurance Coverage

Property insurance in Thailand is designed to cover different aspects of your home. Here are the primary types of coverage:

A. Building Insurance

Building insurance covers the physical structure of your property, including the walls, roof, windows, and any permanent fixtures. This type of home insurance protects against damages from events like fires, storms, and earthquakes. Building insurance is essential for maintaining the long-term value of your property.

B. Contents Insurance

Content insurance protects personal belongings inside your home, such as furniture, electronics, and valuables. If theft occurs or items are damaged due to an insured event, contents insurance ensures that you’re compensated for your loss. This type of coverage is especially important if you own high-value items.

C. Natural Disaster Add-ons

Because Thailand is prone to natural events like floods and occasional earthquakes, many insurers offer natural disaster add-ons. These add-ons provide extra coverage beyond basic property insurance, ensuring that you’re prepared for specific regional risks. This coverage is especially valuable for properties in high-risk areas.

D. Personal Liability Coverage

Personal liability coverage protects you financially if someone is injured on your property or if you accidentally cause damage to another person’s property. This aspect of home insurance can cover medical costs or legal fees, providing you with added peace of mind in case of unexpected incidents.

E. Temporary Accommodation

In case your home becomes uninhabitable due to a covered event, this coverage helps pay for temporary accommodation expenses. Temporary accommodation coverage ensures that you and your family have a safe place to stay while your home is being repaired.

How Much Does Home Insurance Cost in Thailand?

The cost of homeowners insurance in Thailand varies widely based on factors like your home’s value, location, and the coverage amount. Here’s an overview of what to expect:

- Basic Policies: Entry-level home insurance can cost as low as 600 THB per year for minimal coverage.

- Comprehensive Coverage: For higher-value properties or more extensive coverage, premiums can range up to 20,000 THB per year, especially in disaster-prone areas.

Factors Influencing Home Insurance Premiums:

- Location: Homes in areas with high risk of floods, storms, or natural disasters generally have higher premiums.

- Home Size & Value: Larger homes or homes with a higher replacement value will cost more to insure.

- Coverage Needs: Adding extra coverage for contents, specific natural disasters, or liability will increase your premiums.

Savings Tip: Consider bundling both building and contents insurance with the same provider. Many insurers offer discounts for bundled home insurance policies, and it simplifies the claims process.

What Property Insurance Covers (and What It Doesn’t)

Understanding exactly what property insurance covers can help prevent unpleasant surprises when it’s time to file a claim. Here’s a quick breakdown:

A. Covered Events

- Structural Damages: Building insurance covers major damages to the structure of your home from events like fires, storms, and other natural disasters.

- Contents Protection: Contents insurance covers loss or damage to personal items, such as electronics, furniture, and valuables, due to theft or other insured events.

- Personal Liability: Covers medical expenses or legal fees if someone is injured on your property.

B. Common Exclusions

- Maintenance-Related Issues: Damages due to lack of maintenance, wear and tear, or mold are typically not covered.

- High-Value Items: Items like antiques, fine art, or luxury goods may need additional coverage beyond basic contents insurance.

- Specific Natural Disasters: Some property insurance policies don’t include certain natural disasters, like floods or earthquakes, unless you add specific coverage.

To ensure your homeowners insurance covers everything you need, always read the fine print. Ask your insurance provider about any exclusions and consider additional policies if necessary.

Filing a Property Insurance Claim: Step-by-Step

Filing a property insurance claim may seem overwhelming, but following these steps will simplify the process:

- Notify Your Insurer: Call your insurance home insurance provider as soon as the incident occurs to start the claims process.

- Document the Damage: Take photos, record videos, and list any damaged items. This documentation will support your claim.

- Complete Claim Forms: Fill out your home insurance company’s claim forms accurately. If unsure, ask questions to avoid delays.

- Submit Required Documents: Send in all documents, either online or by mail, depending on your provider’s process.

- Meet the Adjuster: An adjuster may visit to assess the damage and confirm your claim details. Be prepared to explain what happened and answer any questions.

- Stay Updated: Keep in touch with your property insurance provider and request updates as your claim is processed.

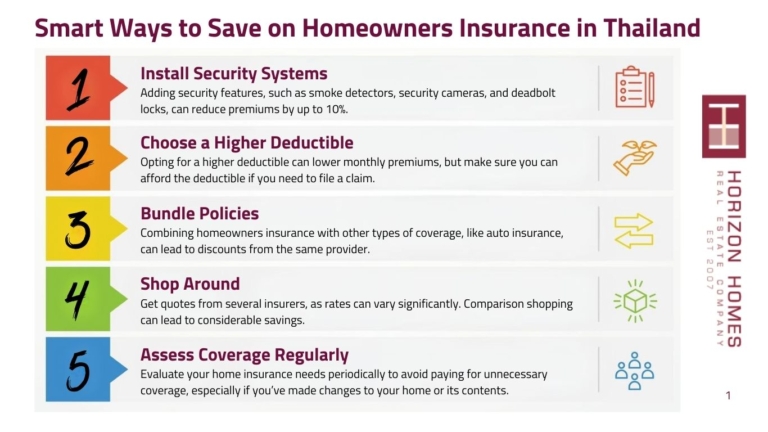

Tips to Save on Homeowners Insurance in Thailand

Saving on property insurance in Thailand doesn’t mean compromising on coverage. Here are a few ways to reduce costs while keeping your home fully protected:

- Install Security Systems: Adding security features, such as smoke detectors, security cameras, and deadbolt locks, can reduce premiums by up to 10%.

- Choose a Higher Deductible: Opting for a higher deductible can lower monthly premiums, but make sure you can afford the deductible if you need to file a claim.

- Bundle Policies: Combining homeowners insurance with other types of coverage, like auto insurance, can lead to discounts from the same provider.

- Shop Around: Get quotes from several insurers, as rates can vary significantly. Comparison shopping can lead to considerable savings.

- Assess Coverage Regularly: Evaluate your home insurance needs periodically to avoid paying for unnecessary coverage, especially if you’ve made changes to your home or its contents.

Conclusion

Choosing the right property insurance in Thailand requires balancing the coverage you need, your budget, and the unique risks associated with your home’s location. By understanding the types of coverage available and comparing options across providers, you’ll be well-equipped to make an informed choice that provides both protection and affordability.

Remember, investing in homeowners insurance brings invaluable peace of mind, safeguarding your home and belongings against the unexpected while allowing you to enjoy life in Thailand worry-free.

Frequently Asked Questions

Property insurance generally covers structural damage, loss of personal belongings, and liability for accidents that occur on your property. Additional protection for natural disasters like floods or earthquakes may require a policy add-on.

Fire coverage isn’t legally required, but mortgage lenders often insist on it, and it’s highly recommended due to Thailand’s fire risk. Fire insurance is typically included in standard homeowners insurance.

Property insurance in Thailand can range from 600 to 20,000 THB annually, depending on the property’s value, location, and coverage level. Bundling policies and installing security systems can help reduce costs.

Contact your home insurance provider promptly, gather evidence, complete the necessary forms, and submit everything to your provider. Be ready for an adjuster visit and follow up to ensure your claim is processed.

Yes, increasing your deductible can lower monthly premiums. However, this means paying more out-of-pocket when filing a claim, so weigh the potential savings against your comfort level.