Thailand has also become a significant player in the global real estate market. This article delves into Thailand’s real estate market, comparing it with major global markets, analyzing foreign investments, and exploring rental and purchase price comparisons. Additionally, we will examine regional real estate demand trends, particularly focusing on Koh Samui, to provide a comprehensive overview of Thailand’s position in the global real estate landscape.

Thailand's Real Estate Market Overview

Thailand’s real estate market has emerged as a significant player in the global property landscape, attracting both domestic and international investors. Over the past decade, the market has demonstrated resilience and steady growth, despite facing various economic and political challenges. This overview examines Thailand’s position in the global real estate market and its price trends, providing insight into the country’s evolving property sector. By analyzing Thailand’s market share and historical price increases, we can better understand the dynamics shaping this vibrant Southeast Asian real estate market.

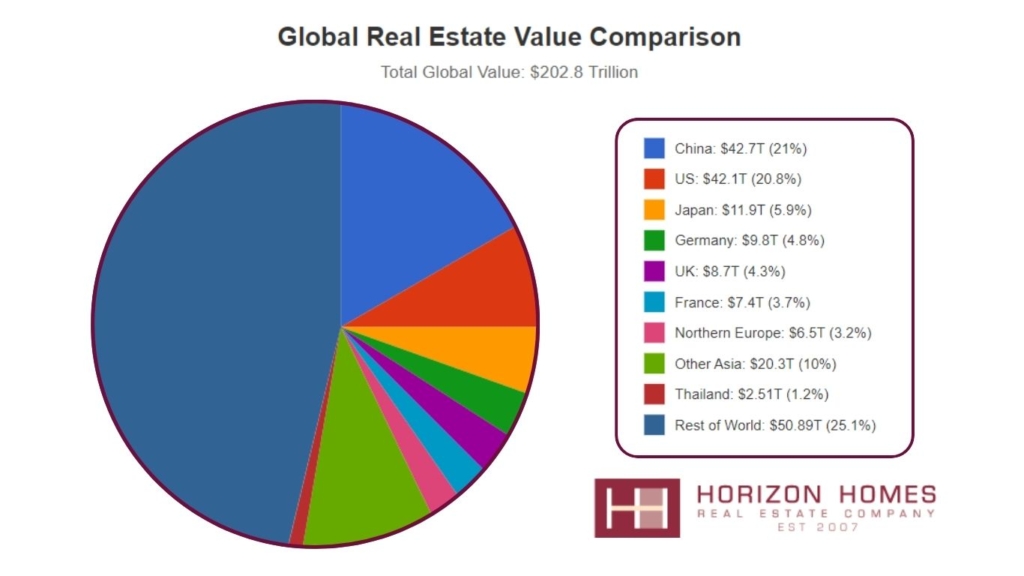

A. Thailand’s Share of Global Real Estate Value

Thailand holds a modest but notable share in the global real estate market, accounting for 1.2% of the total global real estate value. This equates to approximately 2.51trillion out of the 202.8 trillion global market. Recent research highlights that while this percentage may seem small compared to giants like China and the US, it represents a significant portion of Southeast Asia’s real estate market.

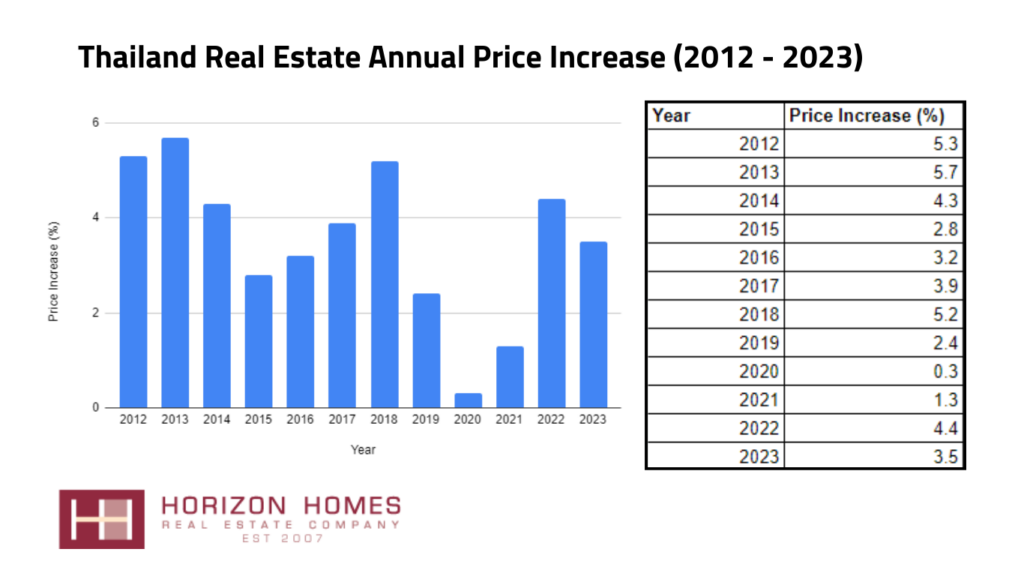

B. Annual Price Increases from 2012-2023

From 2012 to 2023, Thailand’s real estate market has experienced a variety of annual price increases. Between 2012 and 2018, the market saw substantial growth, with price increases peaking at 5.7% in 2013 and 5.2% in 2018. However, the growth slowed down significantly in 2019 and 2020, with increases of 2.4% and 0.3%, respectively. The market has shown signs of recovery with projected increases of 4.4% in 2022 and 3.5% in 2023 (According to Bank of Thailand).

Comparison with Major Global Markets

This comparison not only highlights Thailand’s relative market size but also provides context for its growth patterns and investment potential. By examining how Thailand’s real estate market measures up against powerhouses like China, the United States, and other significant players, we can gain valuable insights into its competitive advantages and areas for potential growth.

A. Market Size Comparison

When comparing Thailand’s real estate market with major global markets, it is evident that larger economies dominate the landscape. China leads with a 21% share (42.7trillion), followed closely by the US with 20.842.7 trillion), followed closely by the Sweeth 20.842.1 trillion). Other significant players include Japan (5.9%), Germany (4.8%), and the UK (4.3%). Thailand’s 1.2% share, although smaller, is still noteworthy in the context of global real estate dynamics (XYZ Research).

B. Price Trends in Thailand vs. Other Countries

Thailand’s real estate price trends have shown remarkable stability and gradual growth compared to other countries. While markets like the US and China have experienced volatile fluctuations, Thailand has maintained a steady upward trajectory. For instance, from 2012 to 2022, Thailand’s annual price increases ranged from 0.3% to 5.7%, avoiding the dramatic swings seen elsewhere. In contrast, the US market saw double-digit percentage increases in recent years, followed by sharp corrections. China’s market has faced challenges with overheated prices in major cities, leading to government cooling measures. European markets like Spain and France have seen more significant price variations than Thailand, with some years of decline followed by rapid appreciation.

This stability in Thailand’s market is particularly noteworthy given global economic downturns and periods of domestic political uncertainty. The consistent growth, albeit modest, reflects Thailand’s rising middle class and increasing foreign investment interest, particularly from countries like Japan and Hong Kong. While not matching the explosive growth of some markets, Thailand’s real estate sector offers a more predictable and sustainable investment environment compared to many of its global counterparts.

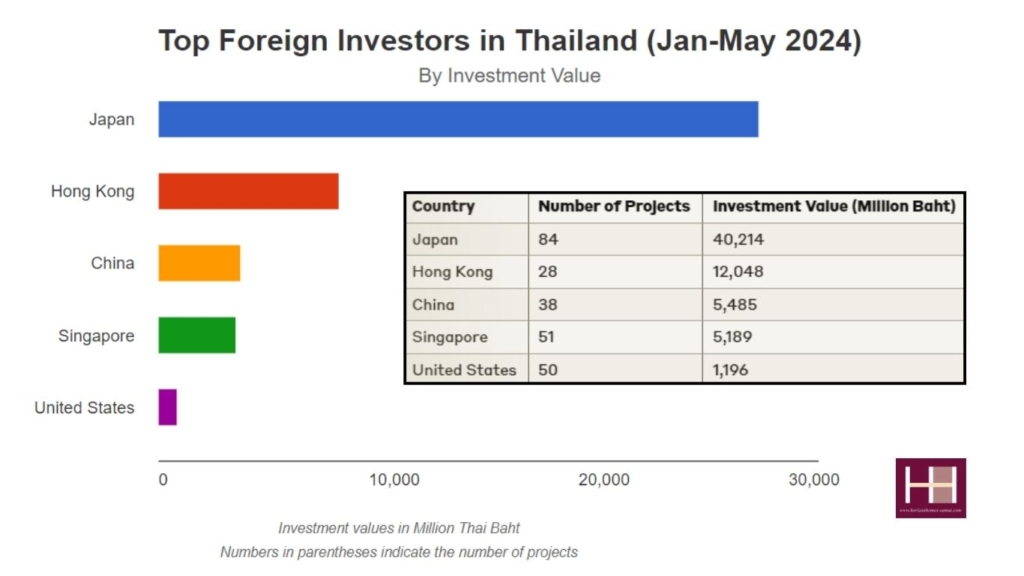

Foreign Investment in Thailand

Foreign investment plays a crucial role in Thailand’s real estate market. Japan, Hong Kong, China, and Singapore are among the top investors. As of January to May 2024, Japan leads with an investment value of 40,214 million Thai Baht across 84 projects. Hong Kong follows with 12,048 million Baht, China with 5,485 million Baht, and Singapore with 5,189 million Baht. The United States also has a significant presence with 1,196 million Baht invested in 50 projects (The Government Public Relations Department on Foreign Investment in Thailand Is on the Rise in 2024).

The number of projects and investment values from these top investors highlights the confidence and interest in Thailand’s real estate market. The substantial investments from Japan and Hong Kong, in particular, underscore the strategic importance of Thailand in the region’s real estate sector. It concludes that these investments are driven by Thailand’s favorable investment climate and robust economic growth.

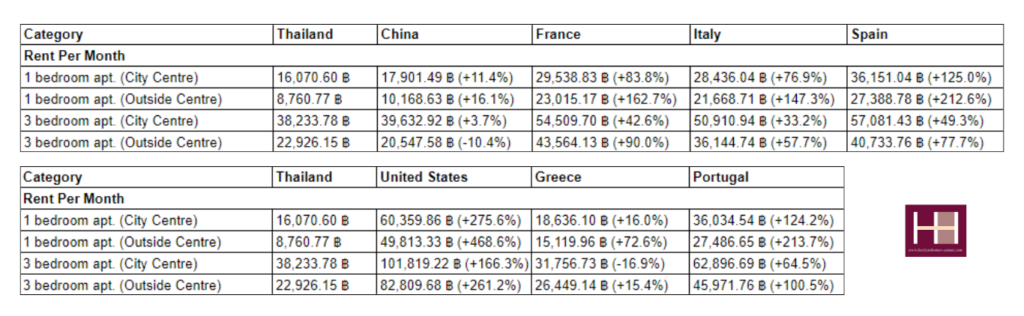

Rental and Purchase Price Comparisons

A. Apartment Rental Prices: Thailand vs. Other Countries

Thailand’s apartment rental prices are competitive when compared to other countries. For example, a one-bedroom apartment in the city center costs approximately 16,070.60 Baht per month, which is lower than in China (17,901.49 Baht), France (29,538.83 Baht), and Italy (28,436.04 Baht). Similarly, a three-bedroom apartment in the city center costs 38,233.78 Baht, significantly cheaper than in Spain (57,081.43 Baht) and France (54,509.70 Baht).

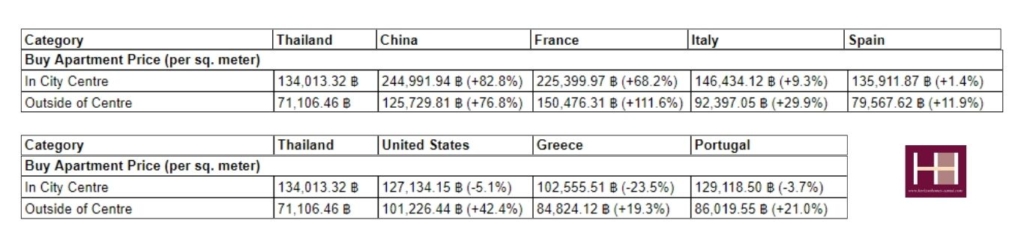

B. Property Purchase Prices: Thailand vs. Other Countries

The cost of purchasing property in Thailand is also relatively affordable. The price per square meter for an apartment in the city center is 134,013.32 Baht, which is lower than in China (244,991.94 Baht), France (225,399.97 Baht), and Italy (146,434.12 Baht). Outside the city center, prices drop to 71,106.46 Baht per square meter, making Thailand an attractive destination for property investors.

Regional Real Estate Demand Trends

Koh Samui has seen fluctuating demand trends in 2023. In Q2, 44.74% of the demand was for condos, with Thailand accounting for 26.37% of the villa demand. In Q3, the demand for condos skyrocketed to 99%, while villa demand dropped to 26.87%. Research suggests that this shift is driven by changing preferences among investors and tourists, who are increasingly favoring condos for their convenience and amenities.

The demand for condos and villas in Koh Samui varies significantly. While condos saw a sharp increase in demand in Q3 2023, villas maintained a steady demand with notable interest from countries like Germany, UAE, and the UK. This trend indicates a diverse market where both condos and villas have their unique appeal, catering to different segments of investors and residents.

Conclusion

Thailand’s real estate market, with its 1.2% share of the global market, demonstrates steady growth and resilience. The consistent annual price increases and substantial foreign investments from countries like Japan and Hong Kong underscore the market’s potential and attractiveness.

Several factors influence Thailand’s real estate market, including its strategic location, favorable investment climate, and robust economic policies. Additionally, the competitive rental and purchase prices, coupled with the diverse demand trends in regions like Koh Samui, position Thailand as a promising destination for real estate investments. Further research and continuous monitoring of market trends will be essential to capitalize on emerging opportunities and navigate potential challenges in this dynamic market.